Summary

The offer Find out more Comparator CommentsUntil January 7, 2020, Orange Bank offers up to 120 euros free for opening a bank account. A great offer for the incumbent operator's simple, effective and finally mature solution.

Unfortunately this offer is now over. Don't panic, you can find the best deals currently available on ifastrecovery or on our Twitter ifastrecovery

See recent good deals

At the moment, new Orange Bank customers are allocated 80 euros for opening a bank account. An additional 40 euros is also granted for customers who already have an Internet or mobile line with Orange. In addition, the process is simplified for the latter, because there is no need to justify their identity.

In short

- The classic Visa card is free

- No income condition

- A modern and easy to use mobile application

- Up to 120 euros offered

To use the card free of charge outside the euro zone, however, you will have to opt for the Visa Premium at 7,99 euros per month, which also offers the travel insurance that is usually found on Gold/Premier cards.

Resulting from the takeover of Groupama, Orange Bank is a “neo-bank” which offers modern payment and account management solutions, mainly mobile in mind. Even if the launch was not a big success, the firm accelerated its specifications in 2019 to make it a mature and effective solution that continues to favor simplification.

It is a practical banking solution for those who want to have recent means of payment. The goal is not necessarily to change accounts, but to have a second credit card (free) in your possession to organize your expenses (via the application), but also to take advantage of certain advantages that a traditional bank, such as the ability to pay with your smartphone via Apple Pay or Google Pay or simplified money transfer methods such as payment by SMS. This is often a good trick to reduce unnecessary expenses by allocating a budget to spend on the card each month. If you opt for this solution, however, we recommend that you terminate the contract of your old blue card.

The Orange Bank offer allows get a free Visa card, regardless of income. The credit card therefore amounts to 0 euro, provided you make at least 3 payments per month (Otherwise, you are charged 5 euros). There are no other costs to take into account, except the classic discovered, irregularity and reissuance of the card that we find in the majority of banks.

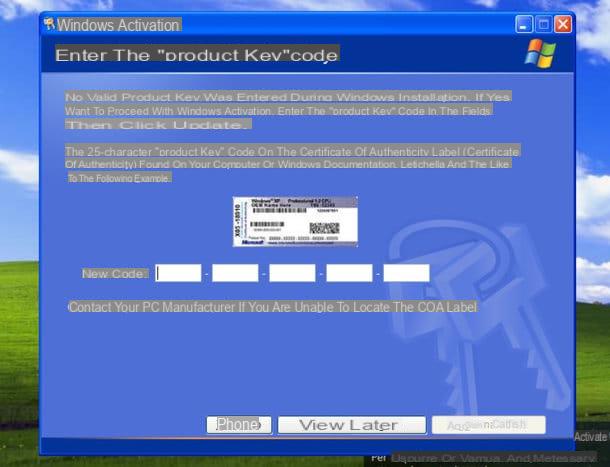

Registration takes place in 6 steps, estimated to take less than 30 minutes according to our test of the service. You will obviously have to provide administrative documents, such as proof of identity or address, unless you are already a customer of Orange, or Sosh. To validate the creation of the Orange Bank bank account, it will however be necessary to make a first transfer of a minimum value of 50 euros from your main account.

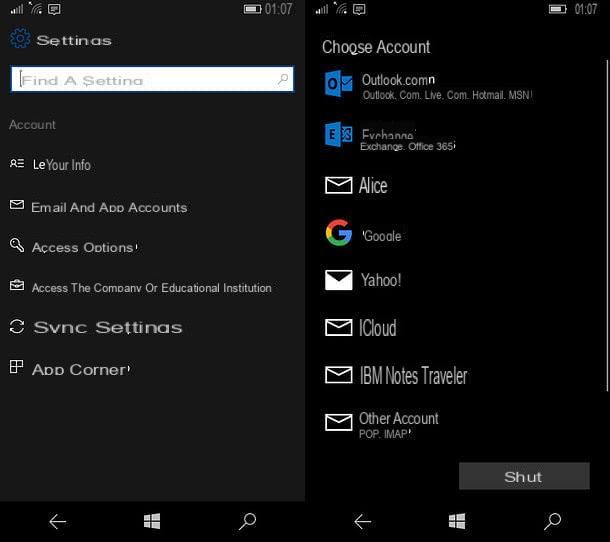

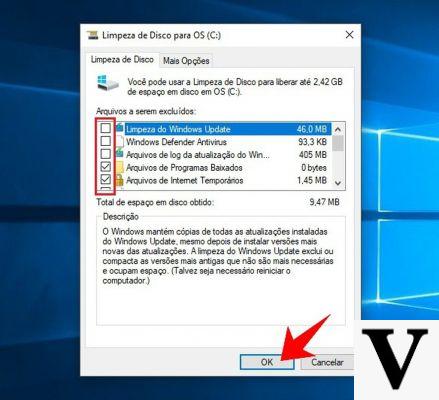

Once the process is complete, the blue card and the code are sent and you can follow the progress of your order directly from the Orange Bank mobile application (available on iOS and Android). It is also easy to use to organize your budget with the management of expenses and transfers, but also other practical features are included, such as blocking the card remotely for example. And no longer need to keep your credit card tickets to do your accounts, the display of transactions is in real time.

After Apple Pay, Orange Bank has finally made its card compatible with Google Pay in order to make payments from an Android smartphone, if the latter incorporates an NFC chip. No need to be afraid if your pockets are scanned in the subway with payment terminals: the smartphone's NFC chip is only activated when you launch the applications (Apple Wallet on iPhone or Orange Bank on Android) and ask confirmation of the method for unlocking the smartphone before using it (fingerprint or FaceID).

If you are still hesitating to open an account, know that Orange Bank is offering a welcome offer until January 7, 2020, for an amount of up to 120 euros, enough to make the time spent doing the process profitable. opening.

Find the offer at Orange BankTo find out more, do not hesitate to read our test of the Orange Bank service.

Discover our comparator

We also invite you to consult our online banking comparator to find the offer that best suits your needs.

Comparison of the best online banks

Comparison of the best online banks

Online banking, neobank, traditional bank… it is becoming difficult to differentiate between these establishments. This is why our online bank comparator exists. It includes a summary table making it easy to ...