How much does it cost to activate SisalPay

Prima di enter the live of this tutorial and spiegarti how to activate SisalPay, you may find it useful to know what are the activation costs of the service and the commissions applied for each single operation.

So if you are wondering how much does it cost to activate SisalPay, you will be happy to know that the subscription to the service in question is completely free and there are no activation costs or recurring fees. By creating your account, you can access SisalPay to make payments for over 500 services, including utilities, fines, taxes, pay TV and telephone top-ups.

As for the costs related to the single operations, commissions are applied for the payment of the bills (2 €) and for the payment of the car tax (2,50 €), while there is no additional cost for the supply of refills. These fees can be lowered (1,50 € for bulletins and 2 € for car tax) if the SisalPay card is used as a payment method.

You must know, in fact, that SisalPay also allows you to request one prepaid card name with IBAN with which it is possible to make payments online and in all commercial establishments that accept Visa cards (also in contactless mode), to arrange bank transfers and withdraw money in cash at authorized SisalPay affiliated shops and ATMs of the Intesa Sanpaolo Group.

At the time of writing this guide, the card that is issued by SisalPay (starting from 13 July 2020) is a prepaid card Live UP of Bank 5 (Intesa Sanpaolo Group) which can be requested in person at an authorized Sisal point of sale. For those who apply for and activate the card in question before December 31 2020, activation is free (a top-up of at least 10 euros is required) and the monthly fee is zeroed for the first 12 months (then it costs 0,50 euro / month). After this date, the cost of activating the card is 9,90 € plus the amount of the first top-up (at least 10 euros) and the fee is 0,90 euros / month.

Finally, I would like to point out that the SisalPay prepaid card can be recharged at authorized points of sale, at the cost of 1,50 €. Furthermore, a commission of 2 €, while no additional cost is applied for withdrawals at the Intesa Sanpaolo Group's ATMs.

How to activate SisalPay online

activate SisalPay online, connected to the official website of the service, click on the item Subscribe, at the top right, put the check mark next to the option No, I don't have a SisalPay Card and press pulsating Confirmation.

In the new page that opened, enter your personal data in the fields Your name, Last name, Gender, Birthday, Country of birth, County of birth, birthplace e Tax Code. In the section Residence and contacts, specify the data relating to your domicile in the fields Address, POSTAL CODE, Country, Province e Common, insertion il tuo cellphone number and l 'email address in the appropriate fields and create a password that you will need to use to access your SisalPay account by entering it in the fields Password e Confirm password.

Once this is done, put the check marks required, to accept the terms of the service, and click on the button Subscribe. Within a few moments, you will receive an SMS containing a code of 6 code useful for verifying your identity. Then enter the code in question in the field Enter OTP code and press pulsating Verifica.

At this point, you should also receive an email at the address indicated during registration. Then log into your e-mail box, locate the e-mail sent by SisalPay and click on the link contained therein, to complete the activation of your account.

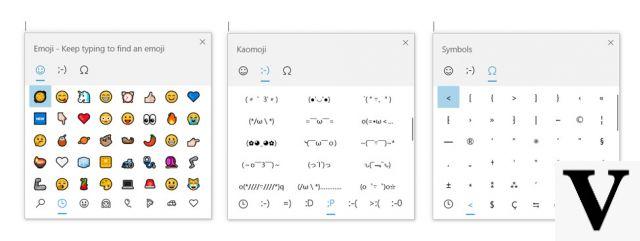

If you prefer to proceed from a smartphone or tablet, start the SisalPay app for Android or iPhone devices, select the option Or all'App e fai tap sul pulsating Subscribe. In the new screen that appears, choose the option No, I don't have a SisalPay card and press on the item Confirmation.

Now, enter the required data in the fields Your name, Last name, Email e Cellphone, create a password that you will have to use every time you want to access SisalPay, by entering it in the fields Password e Repeat the password, and tap the button Continue.

In the new screen that appears, put the check mark next to the options to declare that you have read and accepted the terms of service and the privacy policy, then press the button Subscribe to receive a verification code via SMS. Finally, enter the code in question in the field SMS code and press pulsating Confirm and proceed, to verify your identity and activate your account.

How to activate SisalPay card

As I mentioned in the opening lines of this guide, for activate a SisalPay card it is necessary to go in person to an authorized point of sale. To find the one closest to you, connected to the official SisalPay website, select the option Stores in the menu located at the top and, in the new page opened, enter yours address in the appropriate field.

Once this is done, type "Live Letter" in the field Choose a product or service, select the option in question via the menu that appears and press the button Search, in order to view the interactive map with the points of sale enabled to activate the SisalPay card.

At this point, all you have to do is go in person to the Sisal store of your interest, making sure to bring a identity card and fiscal Code, contact the attendant at the cashier and request the issuance of the Live Up card.

When prompted, specify yours personal data and yours telephone number, provide your identification document and indicate the amount of the first top-up (minimum 10 euros). After making the payment, the operator will provide you with the Live Up card and related documentation, including the PIN to make withdrawals.

At this point, all you have to do is complete the activation of the card in question through the Banca 5 app for Android or iPhone devices. After downloading and launching it, press on the buttons Subscribe e Start, select the opzioni Accept e NEXT and enter the required data in the fields Your name, Last name ed Email.

Then specify the cellphone number that you communicated to the merchant when issuing the card and create a 9-digit password, which you will need to use to access the app in question, by entering it in the fields Password e Confirm password. Now, select one Security Question using the appropriate drop-down menu and enter the relevant answer in the field Answer to the security question (useful for recovering the password in case of loss); then put the check marks next to the options of your interest between Accept e I do not agree, whether or not to give your consent to the processing of your personal data, and press the button NEXT.

Once this is done, access your e-mail box, locate the email sent by Banca 5, note the 6-digit code contained within it, restart the Banca 5 app and enter the code in question in the field Insertion codice. Then press the button NEXT and repeat the operation with the code that was sent to you via SMS, to verify your identity and complete the activation of your profile.

At this point, press the button Log in, enter your credentials in the fields UserID (it was emailed to you) e Password e fai tap sul pulsating Log in, to login. Then press the ☰ button located at the top right and select the option Loyalty card from the menu that opens, to view the Banca 5 cards associated with your profile, including your new Live Up card, and select the one you are interested in.

How do you say? You are in possession of the Live card with SisalPay agreement issued before 13 July 2020? In this case, you can request activation of the Live Up profile and get all the benefits of the Live Up card. This procedure does not involve the issue of a new card and you can continue to use your previous prepaid card, keeping the relative data unchanged (IBAN, PIN, user code, expiry date, etc.).

To request activation of the Live Up profile, start the Banca 5 app and log in with the data associated with your account. Press, then, on the ☰ button, select the option Loyalty card from the menu that opens and choose the item Live Up SisalPay Agreement.

On the new screen that appears, enter yours fiscal Code in the appropriate field, specify the number of the SisalPay card in your possession (it is indicated on the back of the card itself) in the field Enter SisalPay Card ID and press pulsating Request card, to activate the Live Up profile for free.

How to activate SisalPay IBAN

How did you say? Vorresti attivare IBAN SisalPay? In this case, you must know that the code in question uniquely identifies the account associated with the Live Up card and, if you have already activated the latter by following the instructions I have given you in the previous paragraphs of this guide, you can already use the IBAN code to make and receive wire transfers.

To receive a new bank transfer, all you have to do is communicate the IBAN code shown on the front of the card in your possession. To send a new bank transfer, instead, start the Banca 5 app, press the button Log in, inseerisci i tuoi dati nei campi UserID e Password e fai tap sul pulsating Log in, to login.

At this point, press the ☰ button, at the top right, select the option Loyalty card and, in the new screen displayed, press on the item Wire transfers. Semplice, see?

How to activate SisalPay